* Cashback not applicable on cash advances, EMI, rent payment, wallet loads, jewelry, fuel, insurance services, education services, government services & Utility Spends that are not done on Airtel Thanks platform

#Valid on spends of ₹50,000 or more in previous 3 months

Disclaimer:

The highlighted banks are also live with RuPay Prepaid MTS Cards.

For quick On-The-Go payments on the metro, bus, and when parking.

To skip ticket queues, and not your breakfast.

To take the hassle out of the journey.

For secure payment methods.

To have one card that works on multiple modes of transport across India and that also works for retail payments.

The National Common Mobility Card (NCMC) is a feature that creates a stored value in your existing RuPay contactless debit, prepaid or credit card. This offers smooth, secure and hassle-free transactions On-The-Go.

It supports payments for public transit such as metro, bus, parking, as well as retail payments. So, you can travel and shop and travel some more - all with one card. Convenient and integrated, this card works across different cities in India for an endless number of commutes. Oh, and it works for ticketing without needing active internet access.

Click here to know more regarding the above live projects

| Sr. No | Transit Operator Name | Mode | Exclusive/Non-Exclusive | Acquiring Bank | RuPay cards accepted | Payments options available at stations to load NCMC |

|---|---|---|---|---|---|---|

| 1 | Assam State Transport Corporation (ASTC) | Bus | Non-Exclusive | Yes Bank | All NCMC certified banks | Cash |

| 2 | Aurangabad Bus | Bus | Non-Exclusive | Yes Bank | All NCMC certified banks | Cash |

| 3 | Bangalore Metro Rail Corporation Limited (BMRCL) | Metro | Non-Exclusive | RBL Bank | All NCMC certified banks | Cash,UPI,Any Debit/Credit/Prepaid cards |

| 4 | Brihanmumbai Electricity Supply and Transport Undertaking (BEST) | Bus | Non-Exclusive | Yes Bank | All NCMC certified banks | Cash |

| 5 | Chennai Metro Rail Limited (CMRL) | Metro | Non-Exclusive | State Bank of India | All NCMC certified banks | Cash,Any Debit/Credit/Prepaid cards |

| 6 | Delhi Metro Rail Corporation (DMRC) | Metro | Non-Exclusive | Airtel Payments Bank | All NCMC certified banks | Cash,UPI,Any Debit/Credit/Prepaid cards |

| 7 | Gujarat Metro Rail Corporation Limited (GMRC) | Metro | Non-Exclusive | Airtel Payments Bank | All NCMC certified banks | Cash,UPI,Any Debit/Credit/Prepaid cards |

| 8 | Haryana Roadways | Bus | Non-Exclusive | AU Small finance Bank | All NCMC certified banks | UPI,Any Debit/Credit/Prepaid cards |

| 9 | Himachal Road Transport Corporation | Bus | Non-Exclusive | State Bank of India | All NCMC certified banks | Cash |

| 10 | Jammu City Buses | Bus | Non-Exclusive | Yes Bank | All NCMC certified banks | Cash |

| 11 | Kadamba Transport Corporation Limited (KTCL) (Goa Transport) | Bus | Non-Exclusive | Airtel Payments Bank | All NCMC certified banks | Cash,UPI,Any Debit/Credit/Prepaid cards |

| 12 | Mumbai Metro One Private Limited (MMOPL) (Mumbai Metro 1) Reliance Metro | Metro | Non-Exclusive | Airtel Payments Bank | All NCMC certified banks | Not Available |

| 13 | Mumbai Metropolitan Region Development Authority (MMRDA) Mumbai Metro Line 2A & 7 | Metro | Non-Exclusive | State Bank of India | All NCMC certified banks | Cash,UPI,Any Debit/Credit/Prepaid cards |

| 14 | National Capital Region Transport Corporation (NCRTC) | Metro | Non-Exclusive | Airtel Payments Bank | All NCMC certified banks | Cash,UPI,Any Debit/Credit/Prepaid cards |

| 15 | Srinagar Smart City Buses | Bus | Non-Exclusive | Yes Bank | All NCMC certified banks | Cash |

| 16 | Uttar Pradesh Metro Rail Corporation (UPMRC) | Metro | Non-Exclusive | State Bank of India | All NCMC certified banks | Cash,UPI,Any Debit/Credit/Prepaid cards |

| 17 | Noida Metro Rail Corporation Limited (NMRC)* | Metro | Exclusive | State Bank of India | State Bank of India | Cash,UPI,Any Debit/Credit/Prepaid cards |

| 18 | Nagpur Metro Rail Corporation Limited (NMRCL)* | Metro | Exclusive | State Bank of India | State Bank of India | Cash,UPI,Any Debit/Credit/Prepaid cards |

| 19 | Ahmedabad Janmarg Limited (Janmitra Bus)* | Bus | Exclusive | ICICI Bank | ICICI Bank | Cash,UPI,Any Debit/Credit/Prepaid cards |

| 20 | Surat BRTS* | Bus | Exclusive | ICICI Bank | ICICI Bank | Cash,UPI,Any Debit/Credit/Prepaid cards |

| 21 | Kochi Metro Rail Limited (KMRL)* | Metro | Exclusive | Axis Bank | Axis Bank | Cash,UPI,Any Debit/Credit/Prepaid cards |

| 22 | Pune Metro* | Metro | Exclusive | HDFC Bank | HDFC Bank | Cash,UPI,Any Debit/Credit/Prepaid cards |

| 23 | Mumbai Metro Rail Corporation | Metro | Non-Exclusive | State Bank of India | All NCMC certified banks | Cash & UPI |

Note -

Apply for a RuPay Prepaid Card at the metro station and bus depot. This card can be used for transit and retail payments.

OR

Get a RuPay Prepaid MTS Card from instant dispensing machines or counters at the metro stations and bus depots. This is a ready to use card and can be used only for transit purpose.

Check if your current RuPay Debit Card is from the below bank list and activate it for transit. If it is not, please visit any bank branches of the mentioned banks and apply for a new card.

Check if your current RuPay Credit Card is from the below bank list and activate it for transit. If it is not, apply for a new RuPay Credit Card of the mentioned banks on rupay.co.in or bank website/app or bank branches.

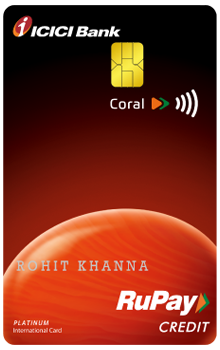

Check whether your RuPay Card is contactless. Look for the above symbol on your card. And confirm if your bank is from the below list. If the contactless symbol is missing on a RuPay Card then visit your bank branch to apply for a new contactless card.

Enable contactless/offline transactions on your card through your bank's mobile or internet banking.

Visit a metro station and ask the operator to activate your card for NCMC

OR

Activate by using bank application and your phone NFC.

Go to a metro station or bus depot/ bus conductor machine and pay via cash/debit or credit card/UPI to add money to your stored value

Log into your bank's internet or mobile banking app/UPI app/Bharat Connect platforms/Partner apps and add money to your card.

After adding the funds, tap your card on an add value machine at the metro station or use your NFC phone to load the transferred amount onto your card. Steps to use your NFC enabled smartphone:

You can check your card balance by:

Tapping your card at the bus conductor’s ticketing machine.

Tapping your card at the add value machine

Tapping your card on the back of your NFC enabled smartphone.

A sudden wave of panic overcomes you when you realise you’ve left your wallet at home.

Well, not anymore.

RuPay cardholders can pay for anything, anywhere, even when their wallets (and cards) are at home.

With RuPay On-The-Go, any device - from keychains and wristbands to rings, stickers and more - can be turned into a wallet. Just link, tap, pay and go. It’s easy, secure, and did we say easy?

Experience the new way to pay.

Key features:

Key features: